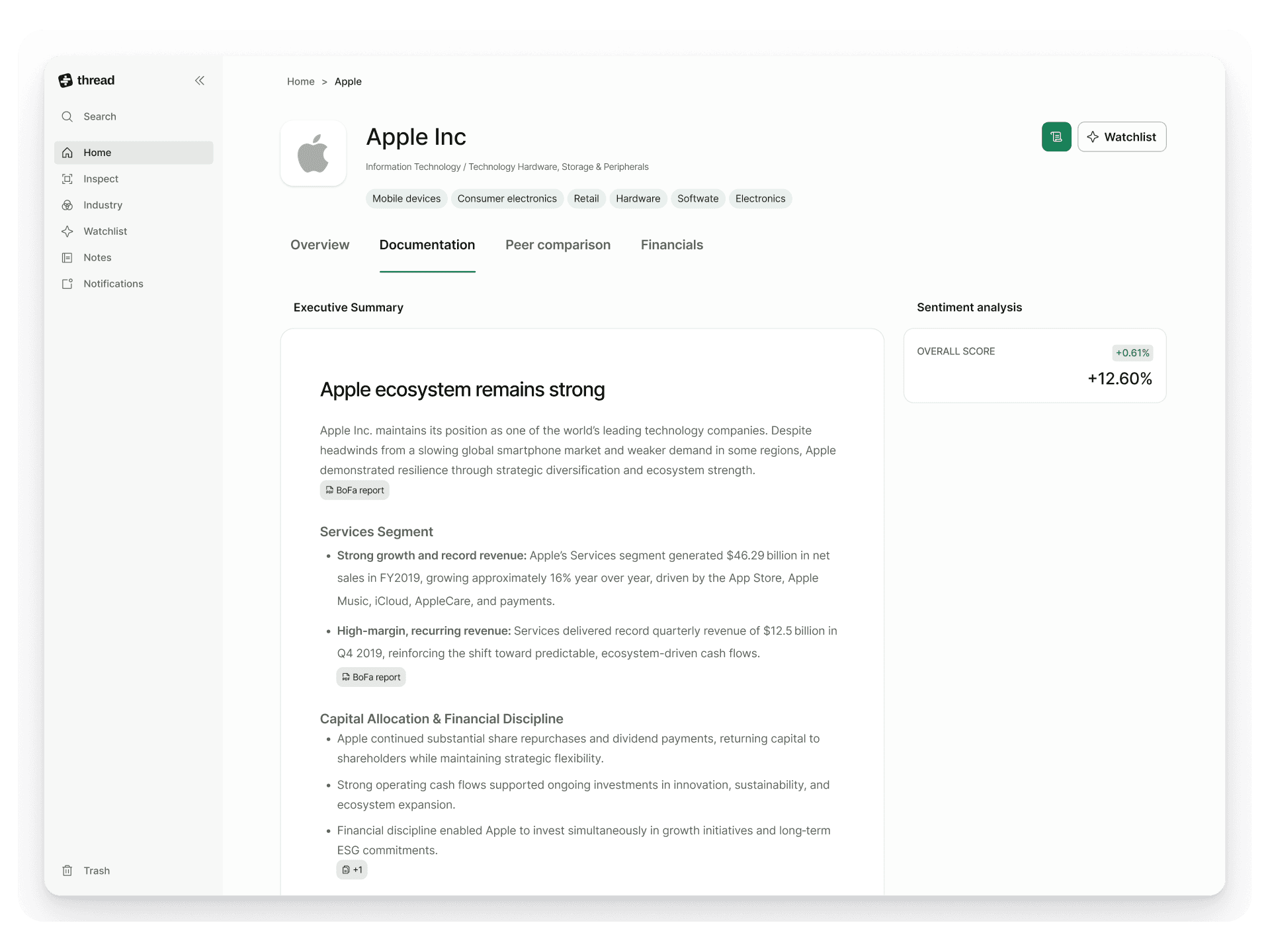

Redefining investment research workflows with AI patterns

Software · 2020

Thread

Unlike static tools that isolate data and hinder investment research, Thread unifies everything in a collaborative AI-powered workspace that connects financial data, ESG metrics, and expert insights to support decision-making.

Scanning and analyzing documents by topic is essential for asset managers to build an investment thesis, but browsing documents individually and extracting data through functions such as ctrl+F had some limitations:

Keywords were just keywords. They lacked meaning relative to predefined or user-specific topics.

Content was scattered, requiring to manually copy and paste it elsewhere.

Documents were not linked to companies, access to the source remained unknown when content was taken from local files.

In 2020, as AI was still emerging, we worked with in-house trained models. Users could upload or browse documents while NLP analyzed content, recognized context, and grouped keywords into meaningful topics beyond isolated terms. This marked a shift in the research workflow.

A Ctrl+F–style approach was tested in the alpha version, but actions were hard to discover, causing side panels to become cluttered and cumbersome to use.

We solved these frictions by designing patterns and interactions that amplified user capabilities with content and surfaced features connecting documents, team knowledge, and previous investment records.

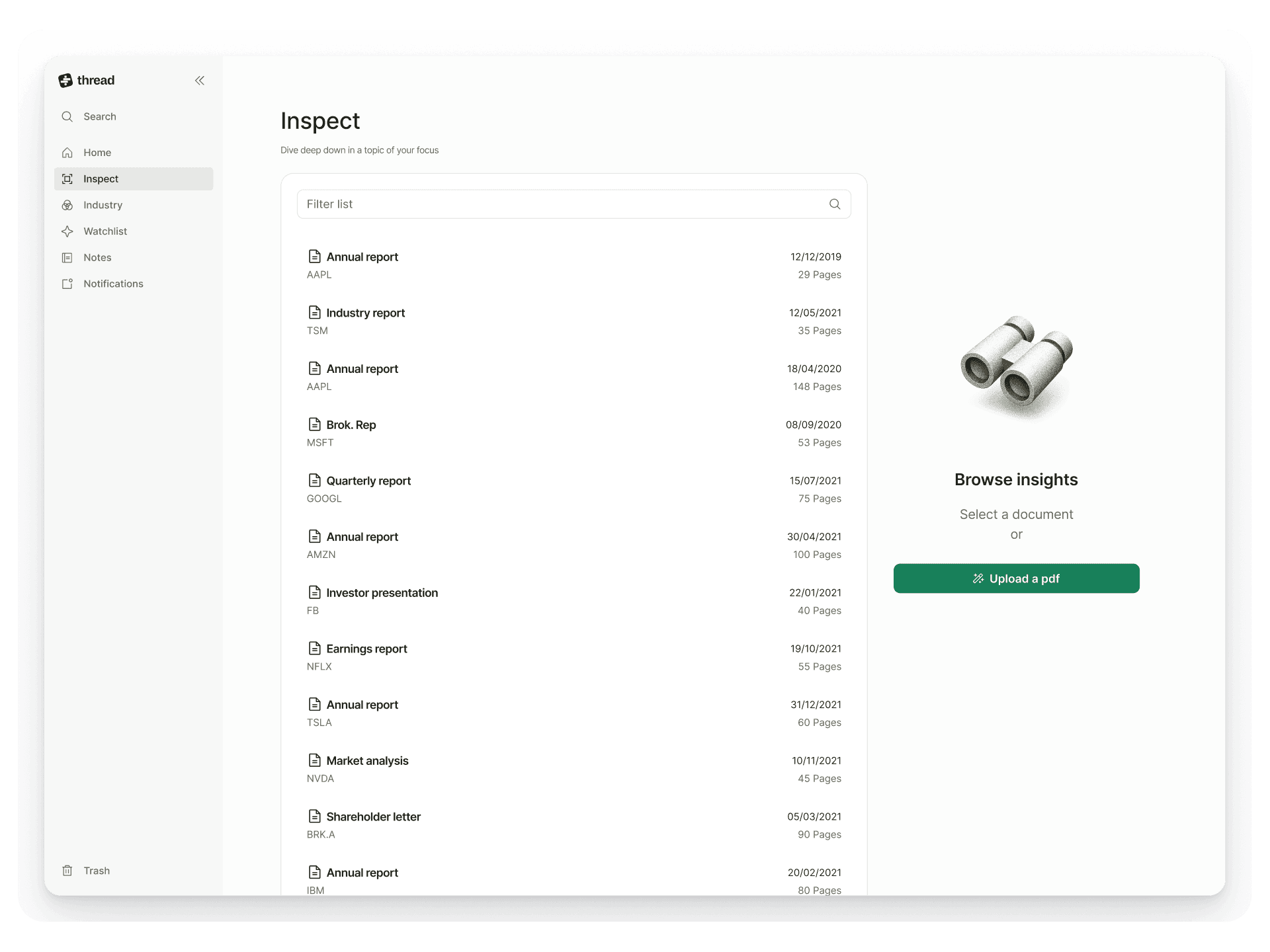

Initial main action

Placing the main touch point with prominent actions or inputs to invite users to start their first interaction.

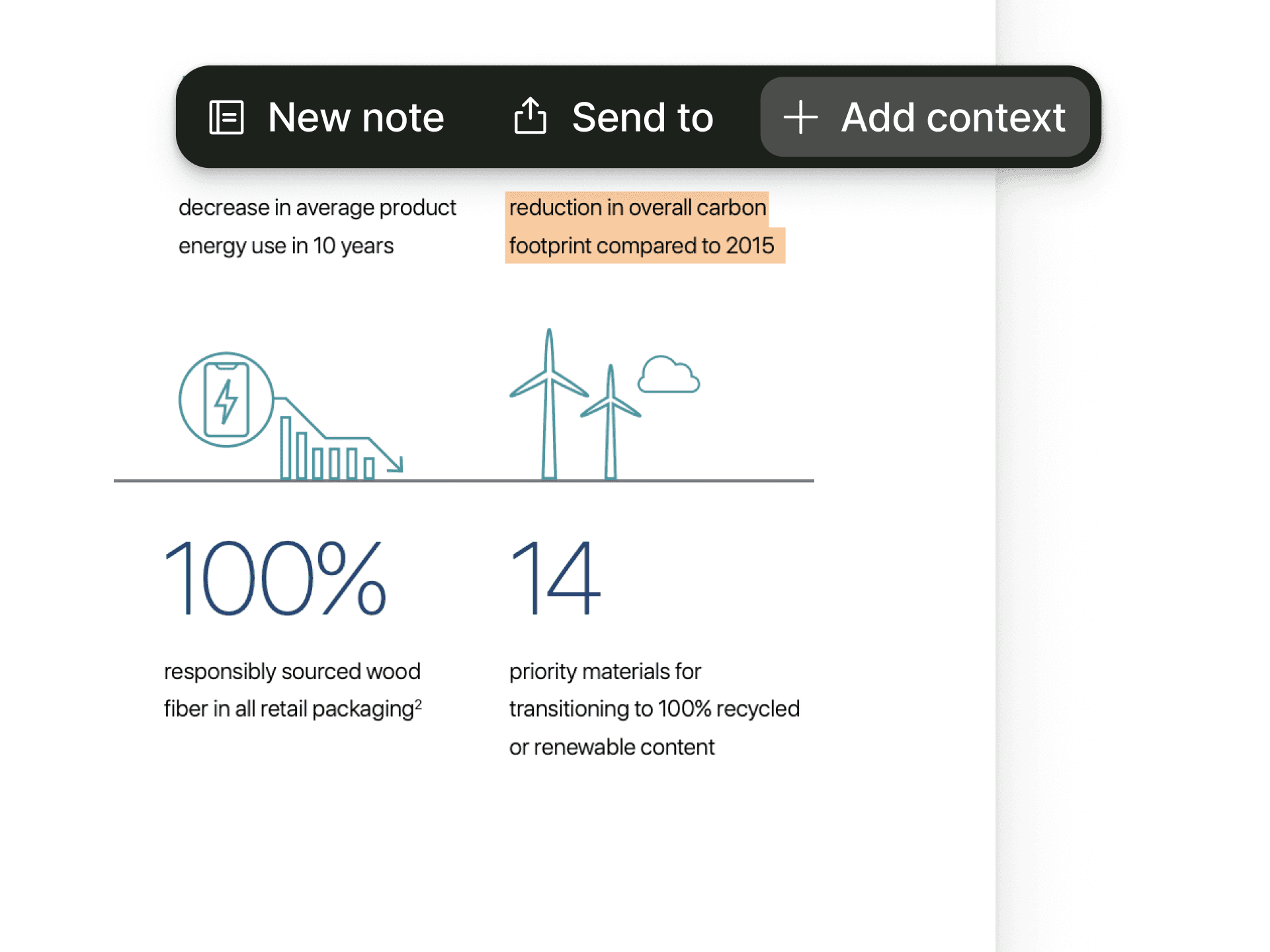

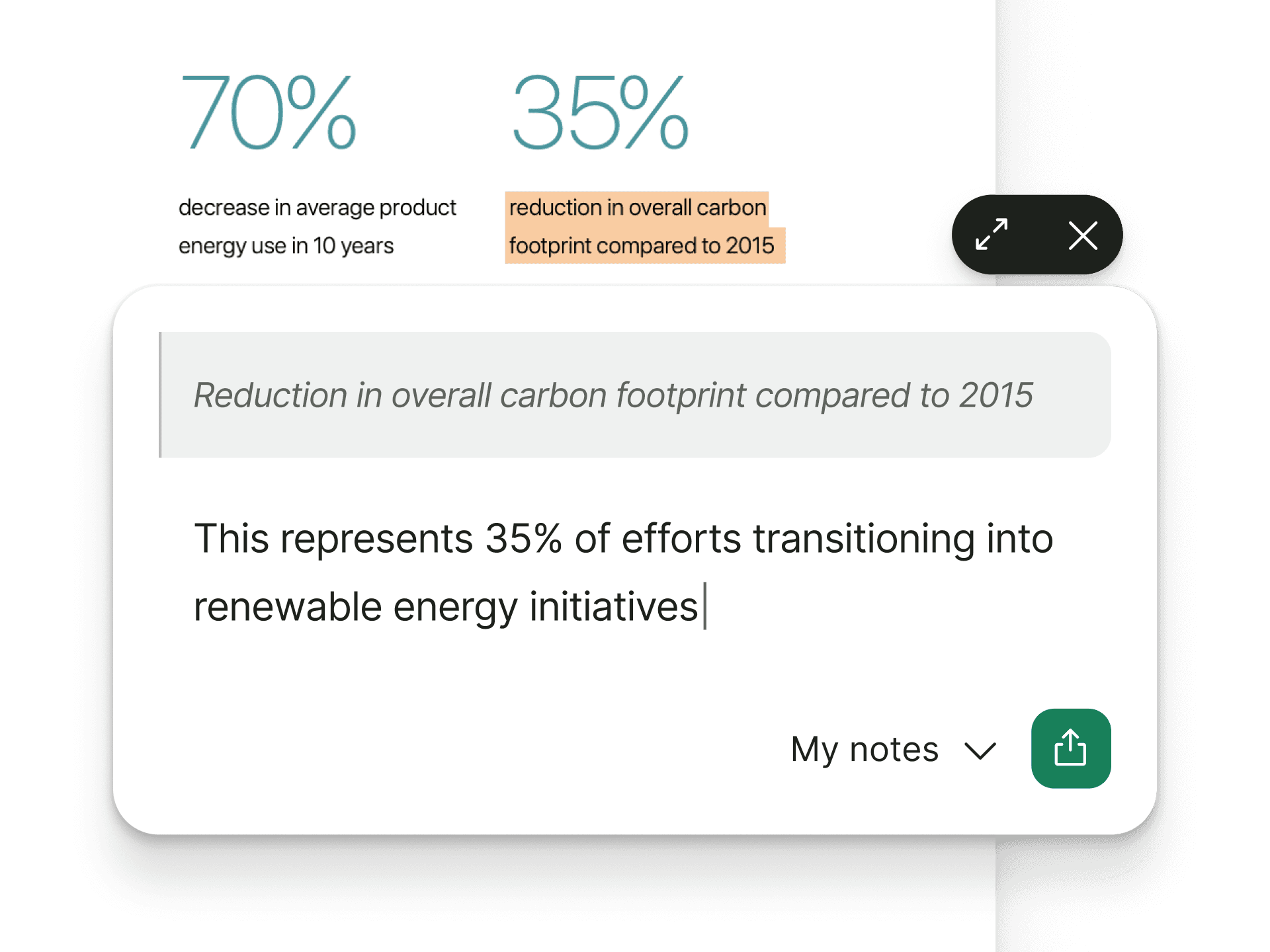

Inline actions

To target content and provide specific options in context. Whether to add them into existing or new notes without breaking the flow.

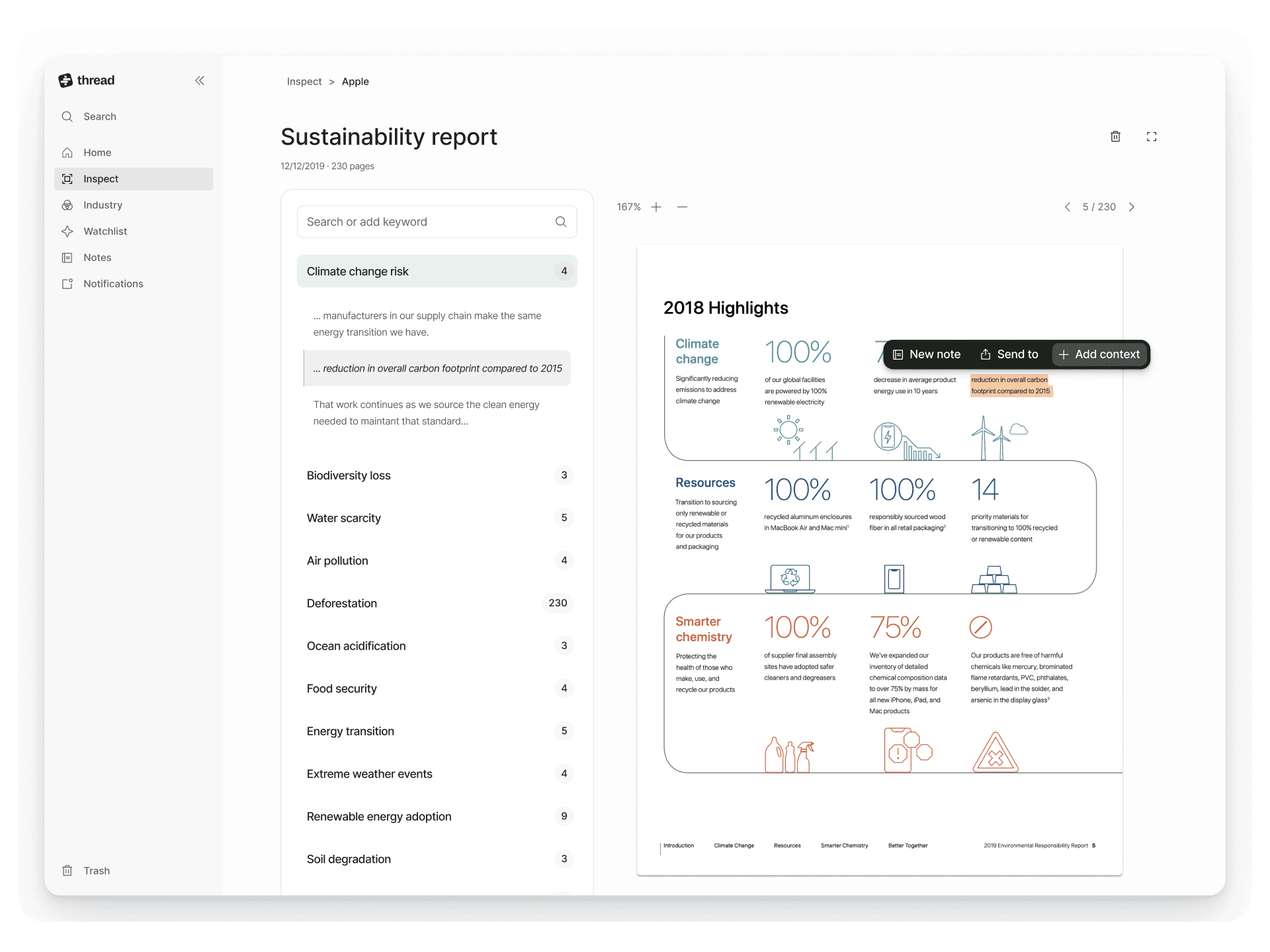

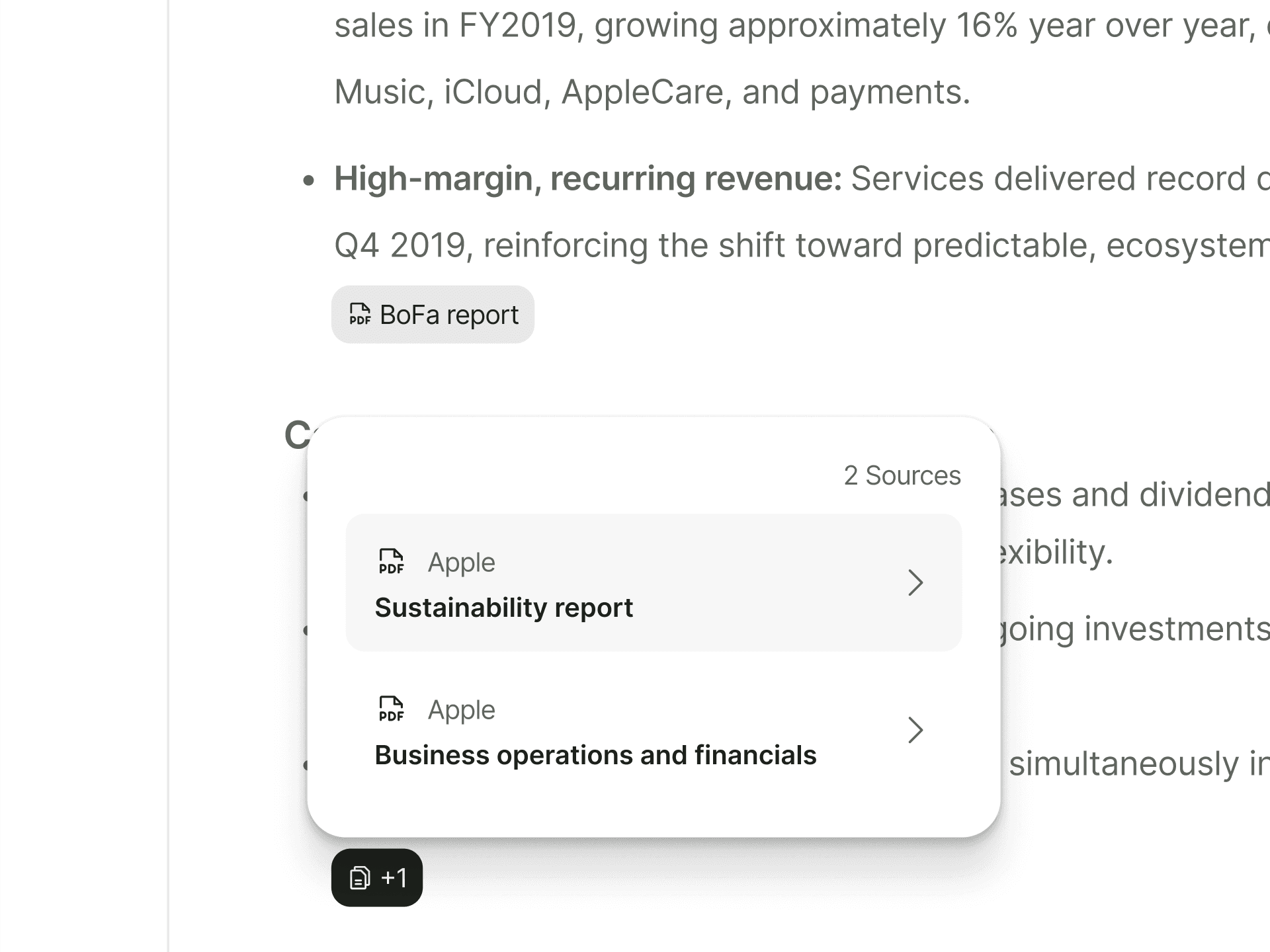

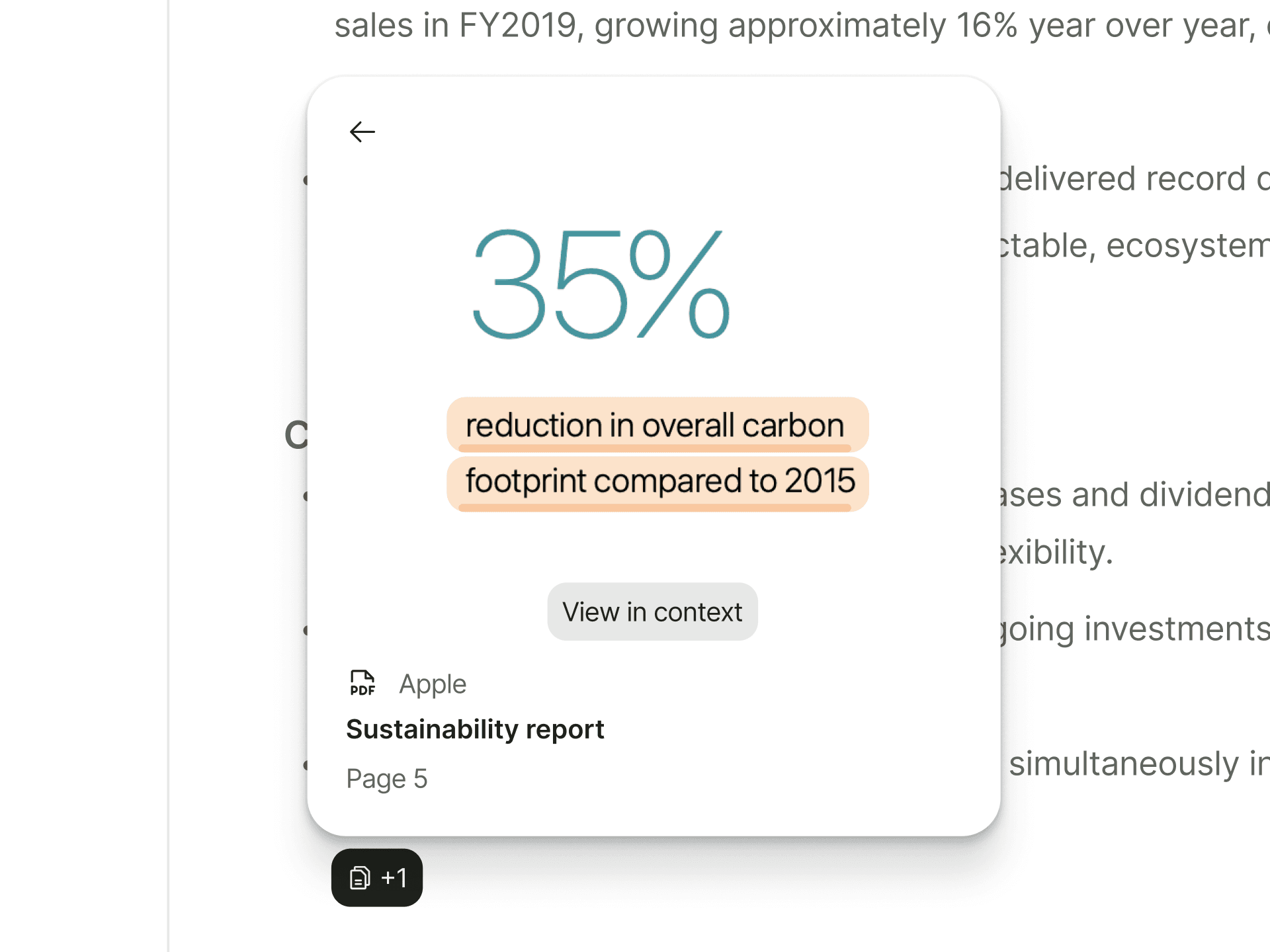

Citations

To reference, navigate and allow visibility on insight sources. This solved the problem on how to connect information across documents, notes and company news. Asset managers could simply enrich investment thesis with expert inputs.

Together, these patterns improved feature discoverability, reshaping collaboration and centralizing team knowledge. This archive of insights provided easier access for more informed investment sentiment, removing the biggest pain point for asset managers: working daily with data scattered across multiple tools.